Mitigating Fraud For B2B Companies

Sip and Solve™ 15-Minute Webinar

With the sudden increase in new small businesses comes an increase in B2B fraud. Many companies find themselves unprepared to handle it. In this 15-minute Sip and Solve session, Bonnie Gerrity digs into the growing problem of fraud in B2B accounts, and how to solve it with a smart layered approach.

We cover fraud trends you need to be aware of, share some interesting case studies from different industries, and close with information on how Experian helps clients mitigate B2B fraud in their portfolio.

Watch this Sip and Solve to learn:

Today we will be walking you through how to create a strategy for mitigating fraud in your commercial accounts.

So why go after commercial entities? There are large lines of credit and large dollar values of product that can be stolen and resold. Also bust out scenarios, where an applicant may receive a large number of credit lines, get that credit and product and then repay none of them, it could be multiple scenarios at a time.

The lack of fraud tools may make it easier for these fraudsters to infiltrate what’s going on inside your commercial process. Also, there are loopholes, especially in cases where you're using both commercial and consumer data as part of your decisioning process.

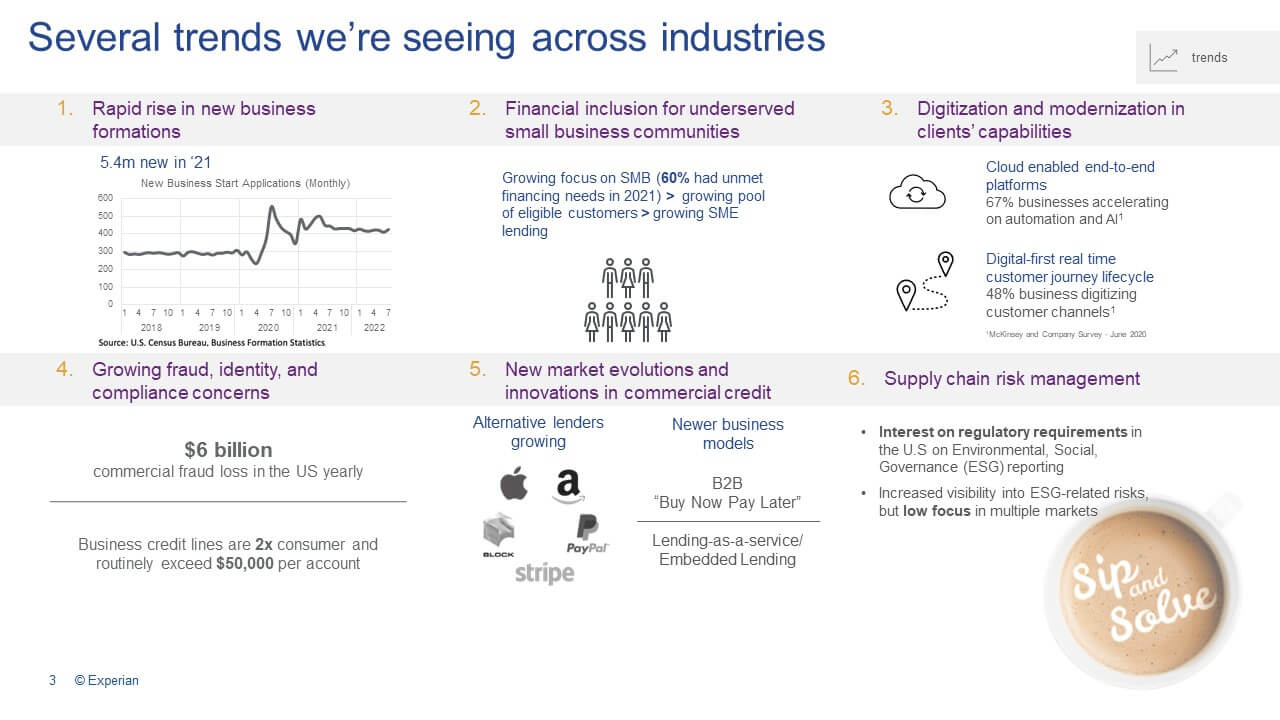

What are some of the trends we're seeing today across industries? On the chart below, on the top left, there has been a rapid rise in new business formations. You can see a big increase in 2020, right during the pandemic, where people decided to stop working and started their own businesses. We saw a huge increase in 2020, and while it has settled down a little bit, we're still seeing many more new businesses created year over year than we had in the past. In fact, there were 5.4 million new businesses created in 2021.

Second, an increase in the application of non-traditional data. Trying to create more financial inclusion for underserved small and medium businesses. Looking for alternative data for onboarding, decisioning, fraud, risk management, and monitoring. We really see permissioned data for small business as the next frontier.

Financial crime is still rising with the shift to digital solutions. Folks are increasing integration and automated solutions. As you can see from the stat in number three, 67% of businesses have accelerated their use of automation and AI.

Number four shows a growing focus on fraud, identity and compliance. Fraud accounts for $6 billion in commercial fraud losses in the US annually, and some of it is not even noticed or determined to be fraud. Business credit lines are two times consumer lines, routinely reaching $50,000 or more.

Fifth, new markets like alternative lenders growing. Newer business models like Buy Now Pay Later (BNPL), Lending as a Service, and Embedded Lending.

Finally, supply chain risk management, focus on Environmental, Social and Governance Reporting (ESG). Also looking at KYC, OFAC information, sanction screening.

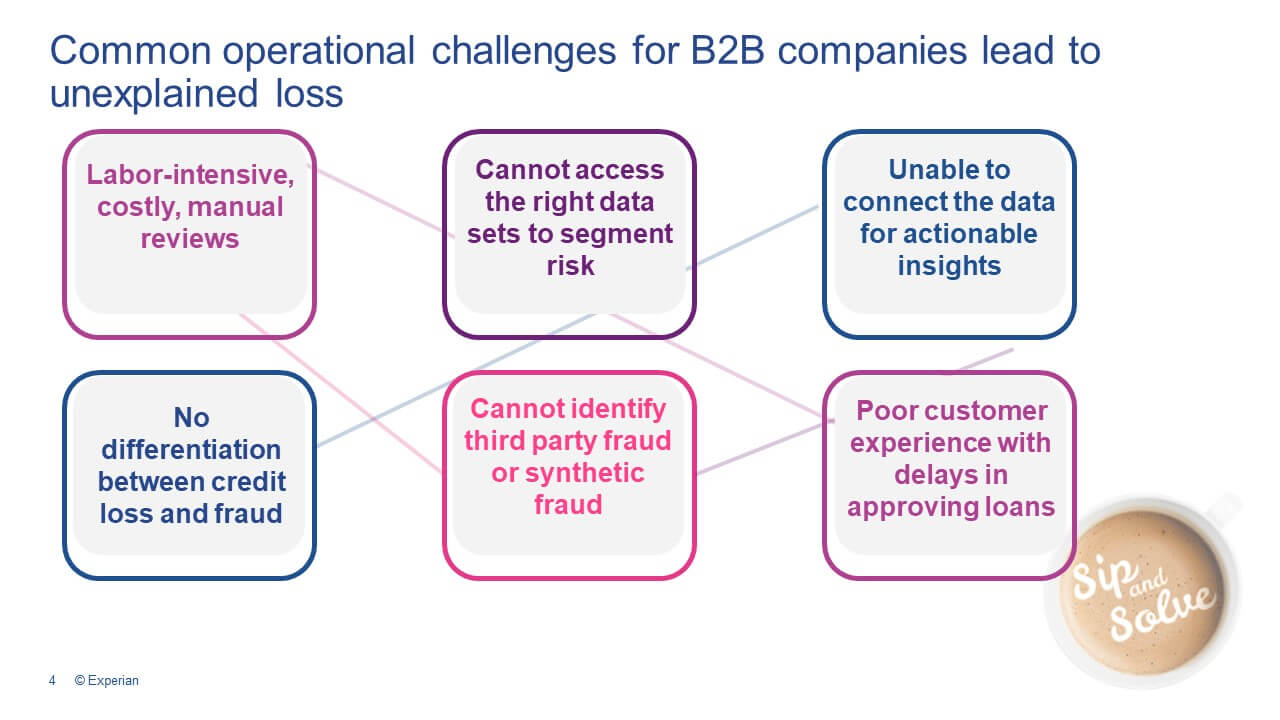

What are some common challenges leading to unexplained losses?

Certainly, not knowing what data to access for fraud, or looking at the wrong datasets, or an inability to connect data. Different services provide identity and fraud data, but you are challenged to connect it, causing loopholes.

In some cases, no differentiation between credit loss and fraud loss, especially with first party fraud. Can you identify third party or synthetic fraud? Identify and segment those losses to determine the impact to the business?

All of this causes manual reviews to stop leakage. Labor intensive manual account reviews to catch fraud in the data can be costly, and the delays in approval translate to poor customer experience and lost customers.

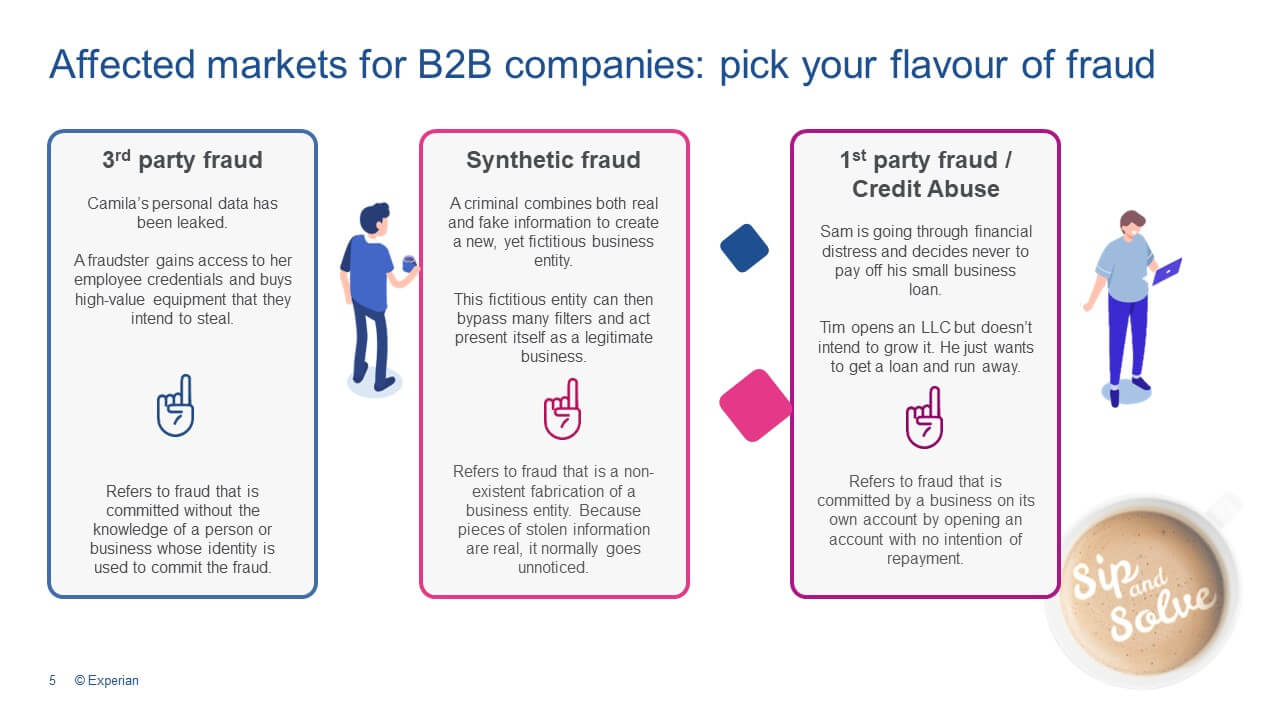

Third party fraud

This scenario is where someone overtakes a customer or business identity and applies for credit.

Synthetic fraud

This scenario is when a criminal provides real but disparate data. Looks legitimate but isn't. Passes fraud tests because some elements will pass screening individually, but not together.

First party fraud

In this scenario, a legitimate entity comes in to do business with you with no intention of paying.

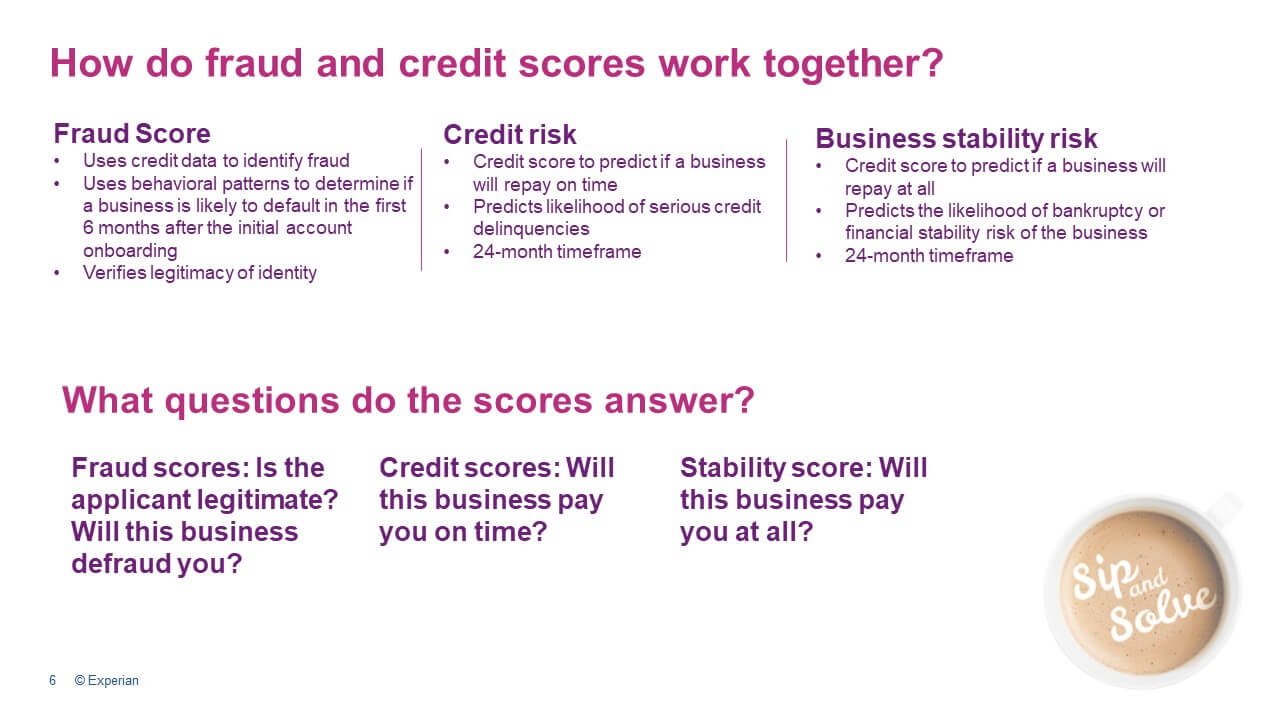

So you need to be thinking about fraud as you do your onboarding. You may have a credit policy, you learn how to navigate credit risk within your portfolio, but you now need to look at fraud risk. Fraud and credit working together, working to determine if you are working with a legitimate business, should I be selling to them, and also determining the creditworthiness of said business.

Fraud score

Helps you identify fraud risk, it uses behavioral patterns to determine default risk in 6-9 months.

Credit risk

Answers the question – Will this business pay me on time? Predicts serious delinquency. What is the likelihood of serious credit delinquency.

Business stability risk

Will this business pay me at all? Predicts the risk predicts severe stress over 24 months.

These scores together can advise on fraud risk and credit risk, to determine if you should proceed with a customer. The scores can also be used in ongoing monitoring.

For example, a customer gives you a new shipping address. You want to verify it is legitimate before updating your system.

Use cases we've seen:

Changing shipping addresses - current client adds a new address but goods go to a fraudulent address.

Drop off of goods at a legitimate location but fraudulent identity or unassociated address. Fraudsters get in this way.

Email variations that differ by one letter. Hard to catch but diverts goods. Manual reviews to catch these are difficult and time consuming.

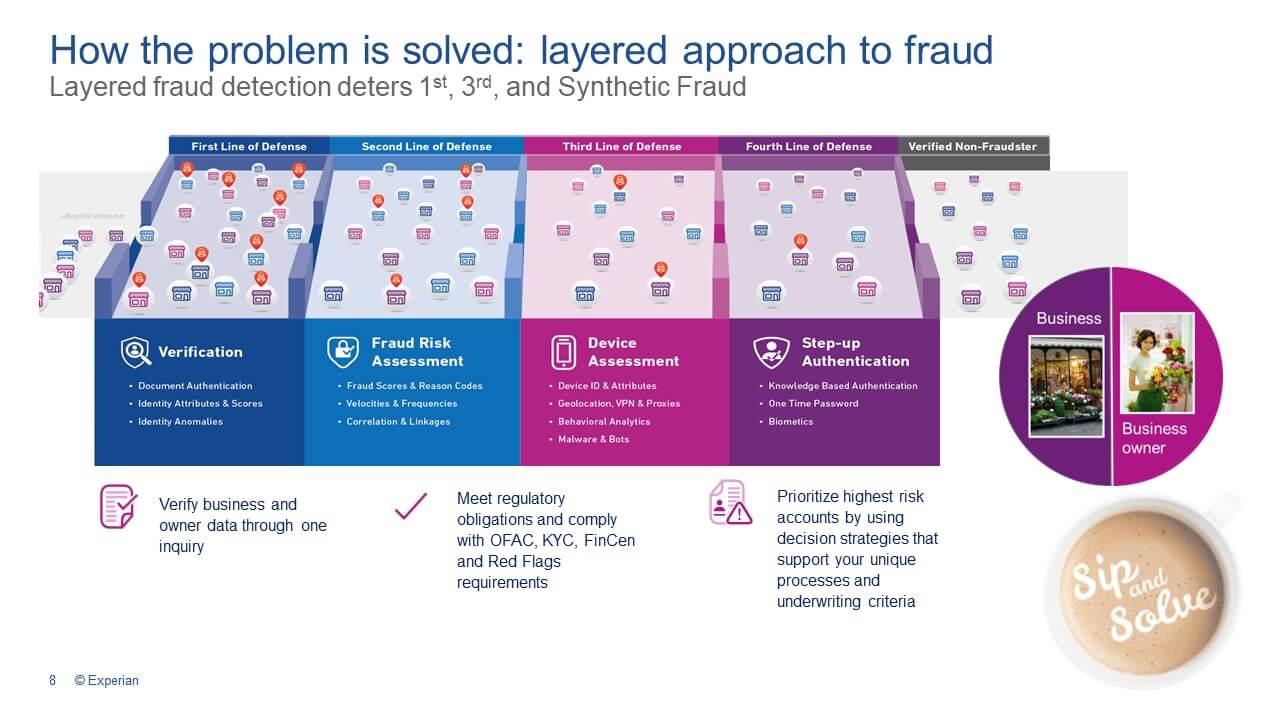

For a full rollout, you really want to focus on different layers of detection.

· Verify business and owner — Check all application data matches and is legitimate

· Review regulatory obligations — OFAC, KYC, looking for red flags

· Assess if device belongs to business — does this device belong to the business entity

These approaches can be phased in, they don’t have to happen all at once. Experian recommends taking a layered approach to mitigating fraud. This helps you to still do your automation. Much of this will fly through with flying colors, but for those fraudulent or higher-risk applications, these are the ones you should be scrutinizing more closely with a manual review.

The result! A process that helps you to mitigate fraud while enabling good customer experience.

Solutions Consultant

Bonnie leads Solutions Consulting for Business Information Services. Her team works with sales to fully understand the client and prospect processes, exposing potential pain points, and assisting the teams in building a plan of products and services to address client needs.

Bonnie brings a deep background in the credit industry, having served as Chief Credit Officer and Vice President, Client Solutions for Credit2B, an Experian partner. She has experience in product management, customer support and onboarding, and commercial lending and has been a featured speaker at numerous industry events.