Expand Safely with International Credit Reports

Sip and Solve™ 15-Minute Webinar

In our increasingly interconnected world, understanding the nuances of international risk is vital for businesses looking to expand their horizons. In this 15-minute Sip and Solve talk, Kyle Matthies, Director of Product Management, shares his take on effective risk mitigation when expanding into foreign markets.

We talk about:

We're seeing a trend toward consolidating international risk management with teams that have traditionally been focused on Domestic portfolios. This is putting people who were not previously responsible for international risk into unfamiliar roles where they're working quickly to understand the differences and nuances of domestic and international risk information. While many of the fundamentals are the same, it's important to be mindful of key differences in data availability and freshness and how those play out around the world and strategies you can use to help mitigate that risk and improve the performance of your portfolio.

Now, many clients are familiar with Experian as the leading U.S. Credit bureau, but what you may not have known is Experian has over 20, 000 employees around the world, operating in 43 countries, Our expertise in consumer and business credit information combined with our global reach, give us a unique advantage in the market. Both at home and abroad.

So no matter where you do business, Experian has leading solutions to help you navigate the complex and rapidly changing business landscape with informed confidence. Today, we'll take a look at how our global reach can help enrich decision making. Especially for a U. S. based clients that are expanding or already operating internationally.

First, let's pause and take a look at some of the common challenges with international business risk management. The first is a lack of coverage. Now, many jurisdictions have limited reporting requirements, which means reports are often incomplete or lack a sufficient data coverage for a sound business decision.

Also, as many companies have tended to have international operations operate independently of their home country, many have found they have fragmented supplier networks covering each of those regions that were developed by those autonomous regions. This has led to increased complexity and cost, a lack of scale in global volume and juggling multiple contracts and invoices. So a lot of friction involved with maintaining so many suppliers.

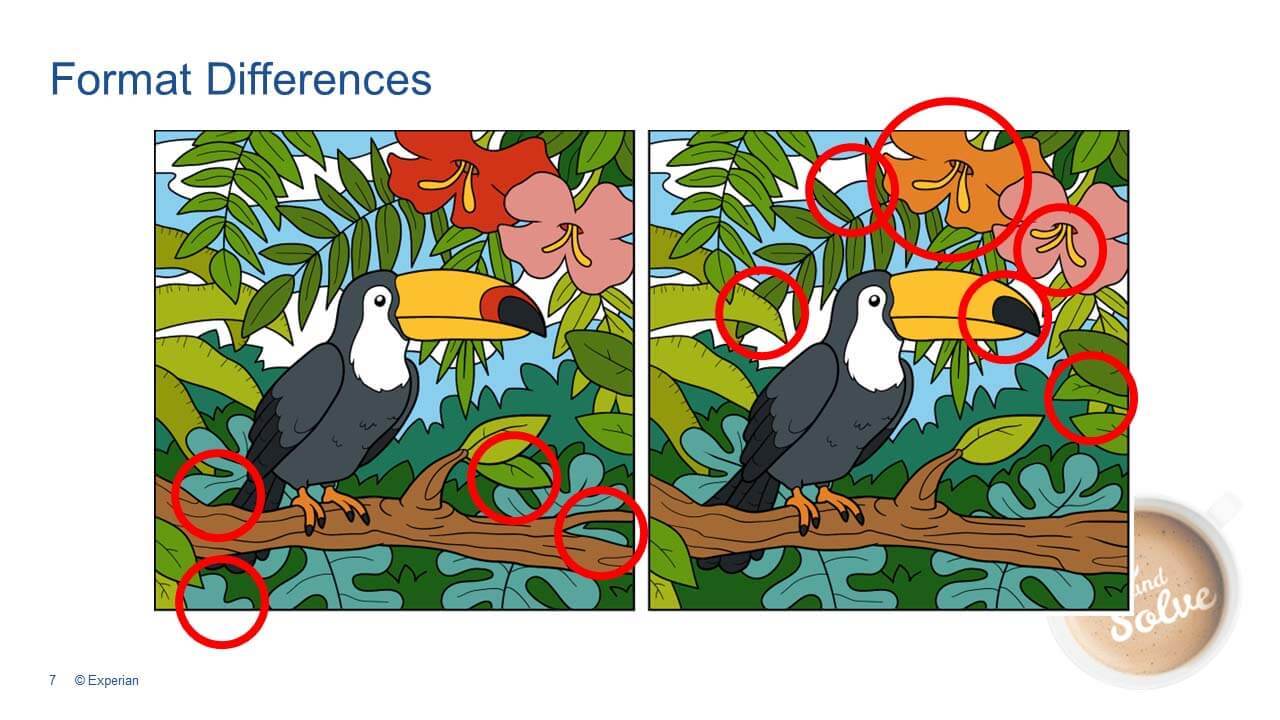

Next up is global consistency - we'll play a fun game here in a bit that looks at how global format differences can make it very difficult to compare reports from one country to another. this can also require multiple credit policies and again, further increases the technical integration of credit solutions.

And lastly, managing stale data reports are often out of date in certain regions of the world, potentially by two, three or more years. And this makes it difficult to rely on a risk analysis and recommendations coming out of those reports, so there's some inherent trade offs here, but we'll present a couple strategies to help deal with that.

Let's take a look real quick at components of reports broadly speaking. And as I said, they're going to share many of the same fundamentals, foundations, first registry information. So this is official legal business name, registered address, the status of the company. And then moving on, we've got some key firmographics. This can include the industry that the business operates in, number of years it's been in business, key figures such as sales information. and then we move into the much more detailed sections, including the risk analysis and oftentimes accompanying credit limit recommendation. we also see the directors and officers. And potentially corporate linkage and ownership.

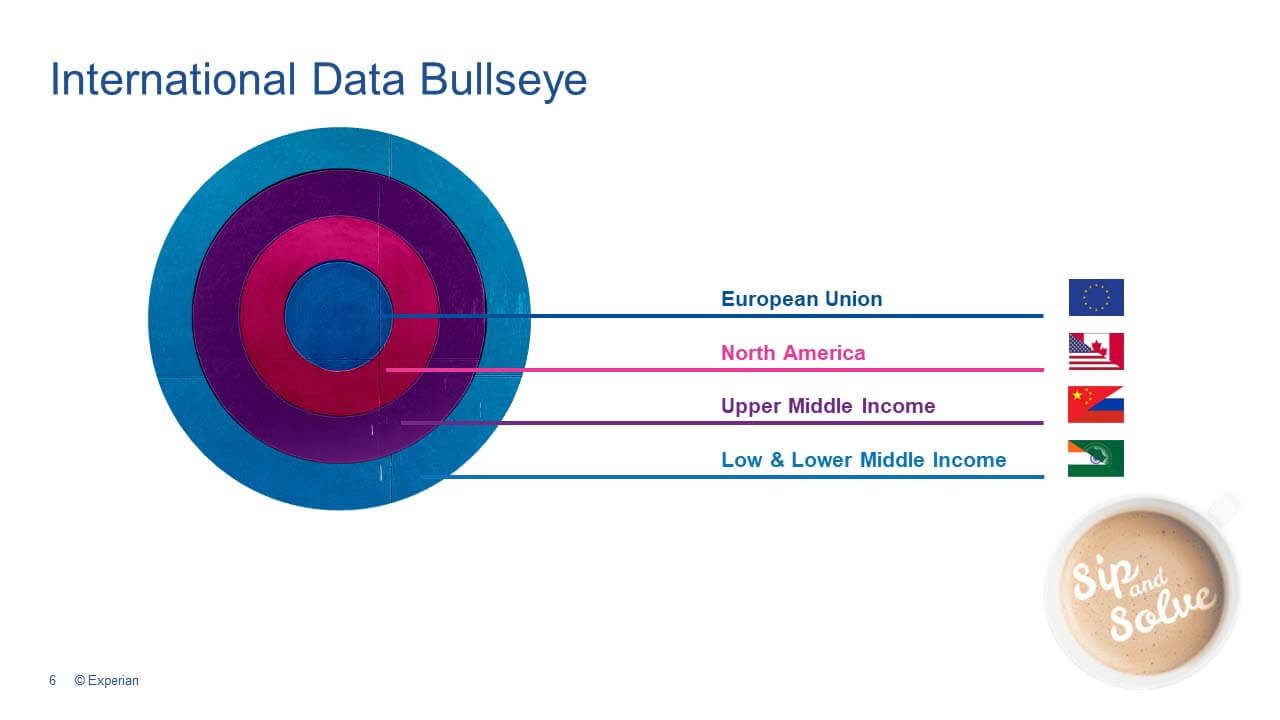

But while this information can generally be consistent around the world, it may not be consistently available from country to country. Now to take a look at how that plays out more specifically, I like to use this international data bullseye.

At the center, the European Union has both the most robust data infrastructure, meaning how quickly data can be updated, in all of its delivery channels as well as the jurisdictions transparency. The transparency really is what drives disclosure of key information publicly. So in the EU we tend to see businesses of all sizes that are required to publicly share at least some of their key financial information if not full audited publicly available financial statements. Whereas moving one ring out in North America, the U. S. and Canada typically will see financial information available on only those public companies that are where there's the requirement to disclose.

However, we do still see a very robust data infrastructure in North America, which means that credit reports will typically be up to date, the underlying data up to date the moment the report ships. But as we move out in these outer rings, the upper middle income, low and lower middle income, we see a degradation of those, the transparency as well as the data infrastructure, meaning less data is required to be made publicly available and the underlying infrastructure, It can be difficult to maintain information so that when reports ship, even if they're delivered in real time, the underlying data may be several years out of date.

Now, as we look at some different solutions with international information, keep this bullseye in mind and where you're doing business and how that may affect some of these key challenges may affect your access to information.

Now, we'll pause really quick to play a little game. I've got 2 girls, 4 and 6, and, they love to play this. My wife and I'll hand out a puzzle like this, at, dinner to buy a few moments of quiet. So take a moment to see if you can spot some differences between the image on the left and the image on the right. I'm sure some have quickly spotted the red beak, possibly the color of the flower petals. I will go ahead and put the answer key up here.

Now this is a game. It works really well girls get excited and my wife and I can enjoy our dinner a little with a little bit more peace, but imagine do you want your credit managers playing this game all day long comparing a French report to a German report to a Brazilian report. The fact is format differences really vary country to country because the controlling bureau is setting that native or domestic format.

Now this is a game. It works really well girls get excited and my wife and I can enjoy our dinner a little with a little bit more peace, but imagine do you want your credit managers playing this game all day long comparing a French report to a German report to a Brazilian report. The fact is format differences really vary country to country because the controlling bureau is setting that native or domestic format.

Now, one of the things Experian has done to help address this problem is by implementing a global business credit report format. This means that French report, the German and the Brazilian report can be compared side by side. And you don't have to play spot the difference. You can also deploy now a global credit policy and much more easily integrate reports from around the world into a single system.

Now, the truth is here at Experian we can deliver report anywhere in the world in real time. But the really important question that clients are looking for is, can I rely on the information in that report? Is the underlying data up to date? And referring back to the data bullseye - the fact is as you get into those outer rings It's more likely the case that the data infrastructure limits how readily available those updates can be in real time.

So as a user, your choice is to take a real time report and be aware that it could be out of date or to order a developed or a research report, which is updated on demand. the benefits of that are that you are going to be getting the latest information, as opposed to having to wait potentially a couple of days for it to be turned around.

But I would suggest that ever since COVID we've seen a very dynamic global business environment, high interest rates, looming in threat of inflation, and oftentimes those reports that are out of date may be very difficult to rely on.

Lastly, let's take a look at how these challenges can affect your credit policies globally.

Now, because of the differences in data, just moving from the U. S. to the EU, where you'd expect alot more financial information, you may be able to make tweaks to your credit policy to take advantage of that. Look at key financial ratios, other statistics that might be helpful in further assessing the risk of a company, but as you move out into those outer rings again, being aware of the lack of information.

Now, because of the differences in data, just moving from the U. S. to the EU, where you'd expect alot more financial information, you may be able to make tweaks to your credit policy to take advantage of that. Look at key financial ratios, other statistics that might be helpful in further assessing the risk of a company, but as you move out into those outer rings again, being aware of the lack of information.

And so, what policies can you bring to bear to help protect from risk? Things like using credit trade credit insurance to help protect against losses or implementing smaller credit terms which then can be built over time and with experience with that particular company. So the fact is it may not be possible to achieve a single cookie cutter approach globally but being aware of the challenges and how you can adapt will help you achieve the greatest degree of success

I want to touch on the some legal challenges that we're seeing globally and how that affects business credit reporting, focusing here on GDPR and similar laws that affect privacy. These are largely understood to affect consumers and natural persons, not to apply to businesses.

At the start, we looked at the inclusion of directors and officers, shareholders, that bringing those natural persons in very key to reports, understanding the risk, who's doing business here, also being able to track for compliance purposes. and yet those do start to make some of these consumer privacy laws more relevant.

I'd like to encourage everybody who's using international data to make sure you're staying up to date with the changes. This has been very dynamic, and so be aware of your obligations that help protect your business.

I manage global data network or GDN here for Experian globally, and want to take a quick look at GDN by the numbers, some key statistics on our coverage.

So we do offer 175 countries with a same day risk report within one business day, you can get a fresh credit report in 175 countries, 94 countries where we have instant verification. This is going out live to the registries to verify the information, as well as now getting in back into credit reports, 35 countries where we have real time coverage of this business information. Again, real time defined as the updates behind the scenes. These reports are always maintained and up to date, 29 of which offer alert monitoring. So you can be kept informed in real time of changes to risk as well as batch scoring where you can run your whole portfolio through periodically, whether that be monthly, quarterly, or even annually, to be able to take a look and stay on top of changes in your portfolio.

Some key points to remember:

We'd be happy to help you, your company, talk through some of your specific challenges and how our expertise can help you better navigate the landscape of international business. You can see more information on our international credit reports here.

Kyle Matthies leads a global team responsible for Experian’s international business information platform. He has over 15 years’ experience spanning several industries and functions, including investment banking, consumer analytics, and product management. In his current role, Kyle manages an international team responsible for Experian’s global BI platform, customer support, and strategic data partnerships. Prior to joining Experian, he worked at Toyota Financial Services, where he pioneered analytics-driven retention programs that achieved increased customer loyalty while paving the way for significant operational savings and dealer support advancements.