Reducing risk through blended credit profiles

An Experian whitepaper

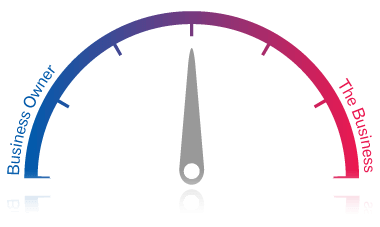

For commercial lenders, slight improvements in risk forecasting can reap significant returns when assessing the credit risk of their small business portfolios. By making a simple adjustment to how they assess risk, they can more accurately filter prospective borrowers, or be alerted sooner to potential problems.

In this whitepaper we discuss the findings of a recent Experian study involving a data set consisting of 80,000 consumer credit profiles linked to businesses. We tracked the records over a three-year period in order to observe both good and bad credit behavior. This research quantified just how important it is to review both a small business’s credit profile, and its owner’s consumer credit profile when assessing risk.

Fill in the information below to download the document.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

If you have questions about blended credit profiles and would like to speak with an expert feel free to call us. Fill out the contact form below to download the whitepaper.