Whether you’re a large corporation or a small business, taking advantage of tax credits can help your overall tax liability and bottom line. A great tax credit you may be eligible for is the Work Opportunity Tax Credit (WOTC). At Experian Employer Services, we offer tax credit services to help you maximize your return while remaining compliant. We can help manage every stage of the WOTC tax credit process for you, so you can spend more time focusing on other areas of your business.

WOTC 101: Everything Your Business Needs to Know

The WOTC credit is a federal tax credit designed to create a more diverse workforce by incentivizing employers to hire employees from specified target groups. To claim the WOTC tax credit, eligibility criteria must be met. In this guide, you’ll learn the eligibility requirements for each target group, the steps on how to claim the WOTC tax credit, the benefits of the WOTC, and how WOTC software can help you overcome challenges to streamline this time-consuming and complex process.

The Work Opportunity Tax Credit is a Federal tax credit that’s available to employers who hire and employ workers from target groups that have faced barriers to employment. The goal of the Work Opportunity Tax Credit WOTC program is to encourage a more diverse workplace. Examples of workers who fall in a target group include military veterans or recipients of food stamps. Employers who hire workers from target groups will receive benefits, as doing so can help lessen claims made on other government assistance programs.

The WOTC tax credit was introduced in 1996 to incentivize businesses to hire people who have difficulty finding employment. However, due to the COVID-19 pandemic and the recent struggles employers have faced, the federal government passed new legislation to extend this tax credit to December 31, 2025, to provide financial relief. If you’re an employer, the Work Opportunity Tax Credit program can be a great way to diversify your workforce and receive tax benefits that can improve your bottom line.

Who Qualifies for WOTC?

The Work Opportunity Tax Credit WOTC program is intended for employers who hire workers from certain target groups. The IRS defines ten qualifying target groups, including:

- Qualified IV-A Recipient: Under this category, individuals must be a member of a family that receives assistance from a state program that’s funded under Part A of Title IV of the Social Security Act, Temporary Assistance for Needy Families (TANF).

- Qualified Veteran: Examples of qualified veterans include those entitled to compensation for a service-connected disability and being unemployed for six months or more or members of a family receiving food stamps for at least three months.

- Qualified Ex-Felon: Ex-felons include those hired within one year of being convicted of a felony and being released from prison for a felony.

- Designated Community Resident: On the hiring date, individuals must be at least 18 years old and live in an Empowerment Zone (EZ) or Rural Renewal County (RRC).

- Vocational Rehabilitation Referral: This target group consists of individuals with physical or mental disabilities and referred to employers while receiving or upon completion of certain rehabilitation services.

- Qualified Summer Youth Employee: Summer youth employees include workers over the age of 16 but under 18 on the hiring date, live in an Empowerment Zone, and only work between May 1 and September 15.

- Qualified Supplemental Nutrition Assistance Program (SNAP) Benefits Recipient: SNAP benefit recipients must be over 18 years old and under 40 and be a member of a family receiving SNAP benefits for the previous six months or 3 of the previous 5 months before their hire date.

- Qualified Supplemental Security Income (SSI) Recipient: Eligible SSI recipients are those who earned SSI payments for any month ending within 60 days that ends on the hire date

- Long-Term Family Assistance Recipient: These individuals must meet certain conditions, such as receiving assistance under an IV-A program for a minimum of the previous 18 months.

- Qualified Long-Term Unemployment Recipient: A person who has been unemployed for at least 27 weeks straight at the time of hiring and who has received unemployment benefits for all or a portion of that time is considered a qualified long-term unemployment recipient.

If you hire any workers who fall under these target groups, you may qualify for the Work Opportunity Tax Credit. At Experian Employer Services, our team can help you read the fine print to help ensure you get credit for hiring qualifying employees.

Who Doesn’t Qualify for WOTC?

As stated, to qualify for the Work Opportunity Tax Credit, you need to hire workers from one of the ten target groups defined by the IRS. If an employee doesn’t meet the eligibility requirements, the employer won’t be able to apply for the WOTC tax credit.

For most target groups, employees need to meet the qualifying requirements within a certain time frame before being hired, such as three months or 18 months. For example, ex-felons must be hired within one year of being convicted or released from prison for a felony. Any felon convicted more than a year before being hired may not meet the WOTC eligibility requirements.

Which Businesses are Eligible for WOTC?

In general, almost any employer can be eligible for the Work Opportunity Tax Credit as long as they hire employees that fall under a target group. However, since the WOTC is a federal income tax credit, the benfit to companies that have operating losses and organizations that are not-for-profit may be limited. The only cateogry that can offset payroll tax is the Qualified Veteran category .

Additionally, some industries tend to hire a more diverse workforce, typically industries that contain a large number of minimum wage positions, such as those in the restaurant, hospitality, and construction industries. These industries tend to be low-skill, making it more likely that they will hire certain target groups, such as ex-felons and veterans. By doing so, most of these employers are able to recover a significant amount of wages by claiming the WOTC tax credit.

How do Businesses Claim Work Opportunity Tax Credit?

If you’re an employer looking to claim the WOTC tax credit, there are several formsthat are required. First, the employer and the job applicant must complete IRS Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit. This form must be completed by a potential employee on or before his/her job offer date, and employers have 28 calendar days from the new employee’s start date to submit it to their state workforce agency. This form screens the job applicant and collects information to ensure applicants meet eligibility requirements.

Along with IRS Form 8850, you will need to complete the Department of Labor’s Form 9061, Individual Characteristics Form. This form helps stage workforce agencies determine whether conditions are met to be eligible for the Work Opportunity Tax Credit.

In addition to completing IRS Form 8850 and DOL Form 9061, when claiming the credit, companiescomplete IRS Form 5884, Work Opportunity Tax Credit and IRS Form 3800, Business Tax Credit, and attach them to your organization’s tax return. Form 5884 requires you to list the hours and wages of your WOTC-certified employees. However, if you’re a qualified tax-exempt organization that hires a qualified veteran, you must attach IRS Form 5884-C to your tax return. Form 3800 claims general business tax credits, including the WOTC tax credit.

The Benefits of WOTC

There are various benefits to participating in the Work Opportunity Tax Credit program and hiring workers from qualifying target groups, such as:

- Tax savings: Employers can reduce their federal income tax liability by claiming a credit for hiring individuals from designated target groups.

- Employee Dedication: Because the WOTC program is intended to provide assistance to employment candidates who face barriers to finding employment, when these individuals are given an opportunity they often excel at the job and are dedicated and loyal employees.

- Enhanced reputation: Businesses that have a commitment to hiring individuals from disadvantaged groups can enhance their public image as a socially responsible organization.

The WOTC Screening Process

As noted, in order to obtain a credit on an individual meeting the eligibility criteria, the candidate must complete the IRS Form 8850 on or before the job offer date. Thus, obtaining the information and the 8850 form (often called WOTC Screening) becomes a critical step in the process when participating in the program. This process can be relatively simple. The first step is to complete IRS Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit. Then, employers must complete the Department of Labor (DOL) Form ETA 9061, ETA 9062, and, if requested, an additional Self-Attestation ETA Form 9175. Once these forms are all complete, they will be submitted to your designated State Workforce Agency (SWA). Often times the process of completing these forms can be built into the job application process.

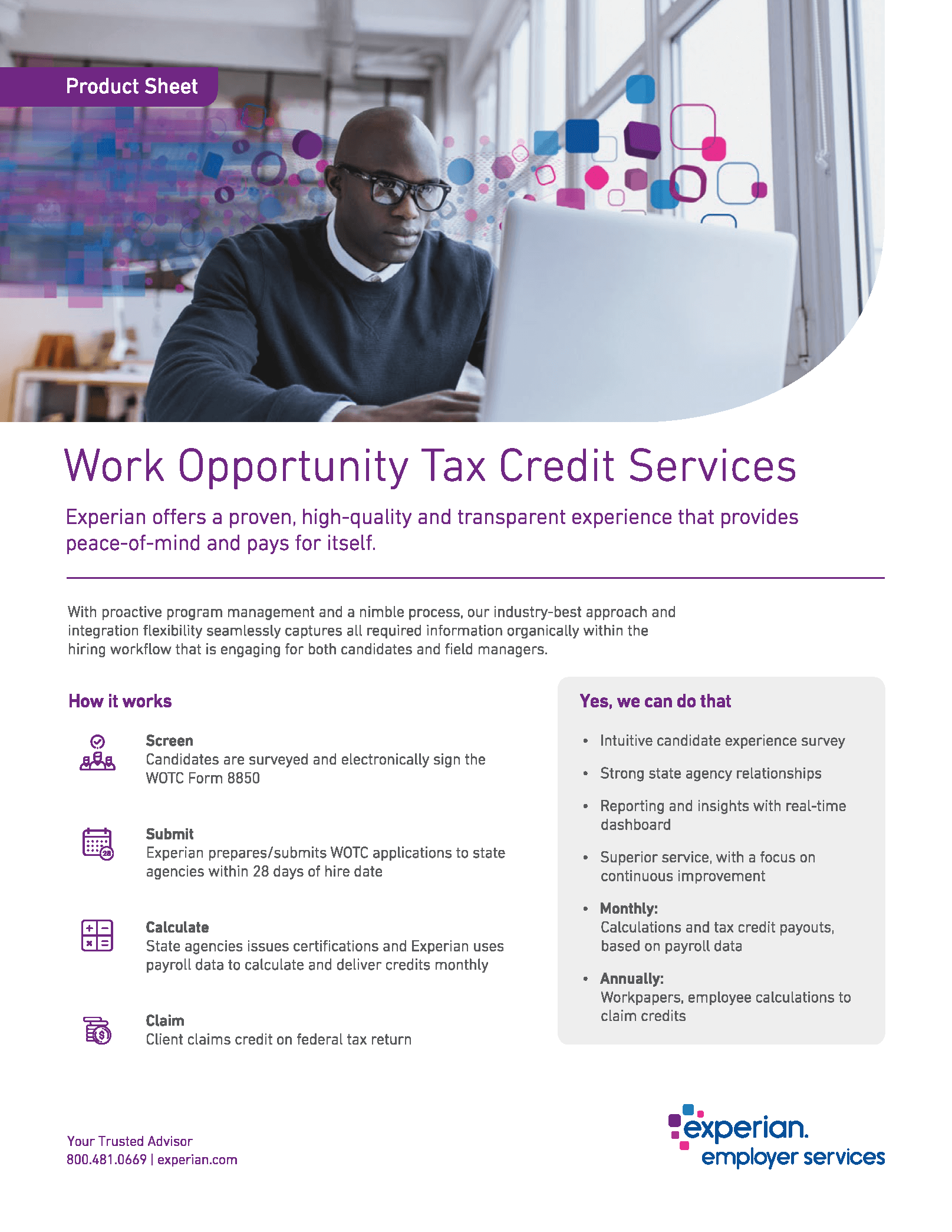

To claim the WOTC tax credit, it’s important to have certain systems in place to remain compliant and take full advantage of the tax credit. With Experian Employer Services, employers benefit from one of the industry’s shortest and most effective surveys. This increases the completion rate while preserving a streamlined talent acquisition process.

In addition to this high performing survey, our team can handle all the logistics relating to the Work Opportunity Tax Credit. By outsourcing WOTC management, you can claim any uncaptured WOTC credits and relieve the burden of researching and collecting information for the WOTC tax credit from your team. From submission to reporting and audit preparations to creating credit forecasts, our experienced team can handle every step of the WOTC tax credit process.

Not only can Experian Employer Services help with WOTC management, but we can help you claim other helpful tax credits, including:

- Research and Development Tax Credit (R&D)

- Disaster Zone Tax Credit

- Family Medical Leave Act Tax Credit

By using the latest tax management technology and tools, we make claiming tax credits easier than ever. With the ability to work faster and more efficiently, you and your team can allocate resources to other areas of your business.

Our Workday Partnership and Integration

Discover our Workday partnership that offers the shortest WOTC survey in the industry to reduce candidate abandonment and automate your payroll feed. Together, we make it easy to maximize your financial returns with our WOTC screening solutions.

Tax Withholding Compliance Services

Make the most out of your tax season with tax withholding solutions that deliver a better payroll experience and ensure compliance.

Unemployment Cost and Claims Management Services

Recover overpayments, receive hearings representation, and remain compliant with ever-changing regulatory requirements with unemployment management services.

ACA Employer Reporting and ACA Compliance Services

Ensure compliant and timely delivery of your ACA statements with ACA reporting services.

The Experian Employer Services Advantage

With Experian Employer Services, you can rest assured knowing you’re remaining compliant throughout every stage of the tax credit process. Our tax software and integrations help eliminate clerical errors, increase compliance, and ensure data is highly secure. With the most beneficial workforce management solutions, you can streamline manual processes to boost efficiency and your bottom line. Employers also benefit from the boutique, high-touch service they value, backed by the power and security of Experian. Schedule a demo with Experian Employer Services today to see how you can take your organization to the next level.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

WOTC FAQs

No, you cannot rehire a former employee and qualify for the Work Opportunity Tax Credit. Employees can only help businesses qualify for the WOTC tax credit the first time they were hired.

In order for an employer to qualify for the WOTC tax credit, they must hire an employee from a target group. However, the time an employee must hold a position depends on the target group. For target groups A-H and L, employers can qualify for a 40% tax credit for employees working 400 hours or a 25% tax credit for employees working at least 120 hours but less than 400 hours. For target group I, Long-Term Family Assistance Recipient, employees must work at least 180 days or 400 hours for an employer to claim the WOTC tax credit.

Businesses that qualify to receive the Work Opportunity Tax Credit can enjoy a reduction in the taxes they owe by up to $9,600 for each qualifying employee who was hired before December 31, 2025. However, because the credit is a function of wages paid, hours worked and eligible group, it is unlikely most candidates will be generate the $9,600 maximum amount. An effective WOTC screening process allows companies to identify the all categories for which a candidate may qualify, ensuring the credit amount can be maximized. How is WOTC calculated?

Calculating the WOTC is relatively straightforward, as businesses who hire WOTC-eligible employees can receive a tax credit that, for most of the eligible groups, is equal to 40% of up to $6,000 of wages paid. These qualifying employees must perform at least 400 hours of work during their first year, with the maximum credit typically equating to $2,400.

However, employers can still claim the WOTC on 25% of wages to eligible employees if they work at least 120 hours but fail to meet the 400-hour minimum. For employing certain qualified veterans, employers can use up to $24,000 in qualified wages when calculating the WOTC.

For more information and resources, visit the U.S. Department of Labor to employ WOTC services. At Experian Employer Services, our Work Opportunity Tax Credit Services can help you identify eligible employees and ensure you’re following compliance standards when claiming the WOTC. Contact us today to learn more about our WOTC solutions.

Yes, the Work Opportunity Tax Credit benefits employees, particularly those who come from target groups that are historically underemployed or face significant barriers. Through the WOTC, stable employment and further career opportunities become available to target groups like veterans, food stamp recipients, ex-felons, and other groups who may have difficulty finding employment. Additionally, by hiring from these groups, organizations can enjoy a more diverse workforce that fosters innovation and creativity by drawing on the skills and experiences of employees coming from different backgrounds.

WOTC: Tax Credit Overview and Tips

The Work Opportunity Tax Credit is a federal tax credit program that encourages businesses to hire employees from certain disadvantaged groups by providing an income tax credit that offers a dollar-for-dollar reduction of taxes owed. Learn more about the WOTC program, how it works, best practices and more.

WOTC Benefits

Federal tax credits can provide businesses with a wide range of benefits. One of the top federal tax credits is the WOTC, which is a federal tax credit program that encourages businesses to hire employees from certain target groups that have historically faced barriers to employment, such as veterans, food stamp (SNAP) recipients, ex-felons and more. Explore the benefits of the WOTC program and how hiring employees from certain target groups can help your business.

Seven Steps to Streamline Your WOTC Process

The Work Opportunity Tax Credit can be a great way for employers to boost their bottom line by hiring employees from target groups facing consistent employment barriers. In this guide, we uncover the steps to streamline your WOTC process, from understanding the WOTC program to learning about the different target groups, understanding the WOTC forms and more.

Watch: Simplify Hiring While Securing Tax Credits

In this Work Opportunity Tax Credit webinar, you will learn from industry experts how HR departments can navigate administrative burdens when securing tax credits. Throughout this webinar, you can gain a better understanding of the processes you can implement to simplify hiring, tips for improving onboarding and strategies for capturing tax credits to save money with each new team member you hire.