Velocity Vehicle Market Solutions

Velocity Market, Velocity Risk, Velocity Performance & Velocity Refinance.

Experian helps auto lenders drive sales, manage risk and gain a competitive edge with powerful insights delivered on our Velocity reporting platform. All four available options give dashboards, reports and analytics that provide insights to help you understand new and used auto sales and finance trends, adapt to change and deploy effective strategies. From sales and dealer relationship management to pricing and performance, Velocity provides clear, data-driven solutions to your challenges.

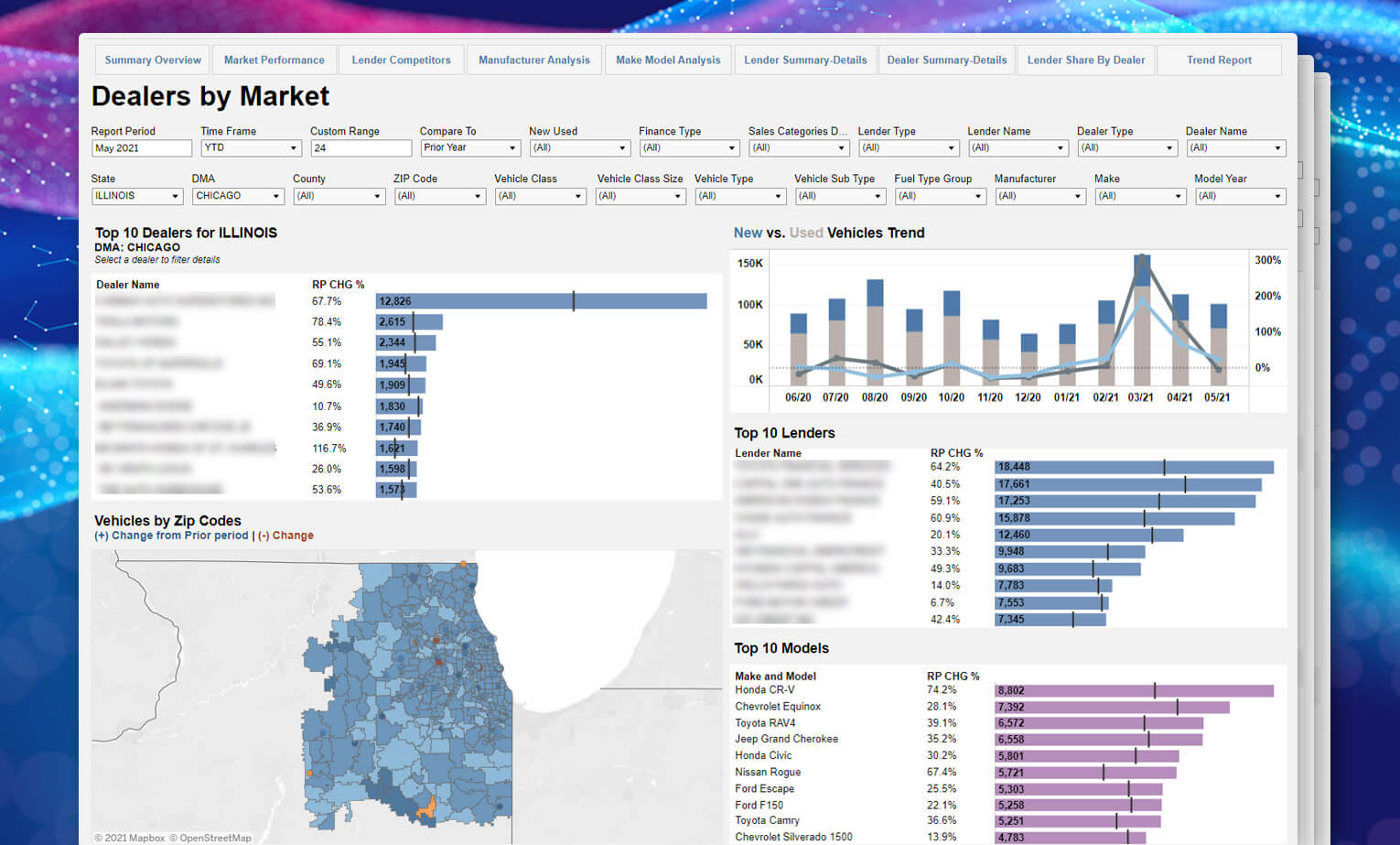

Visualize new and used auto sales data to enable powerful strategies to grow and defend your revenue.

Plus Velocity Market Report Builder provides full interaction and customization of the data.

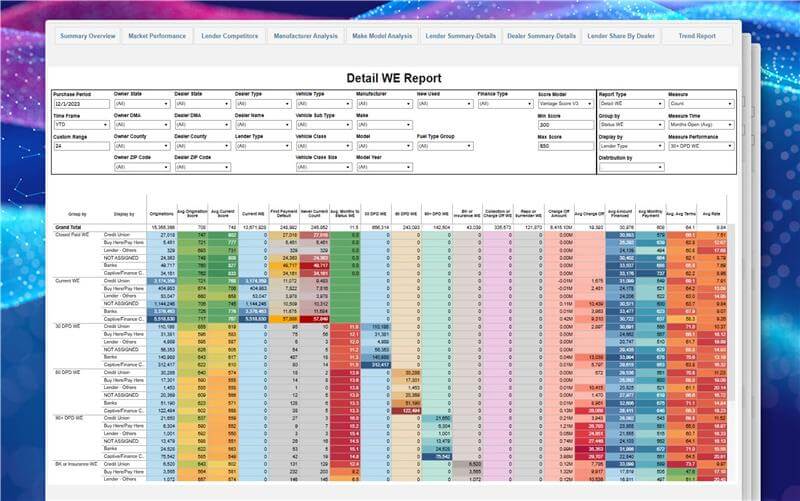

Velocity Performance enables you to understand loan outcomes over time. It delivers comprehensive automotive loan and lease performance details across multiple metrics and dimensions to help you better understand automotive origination risk.

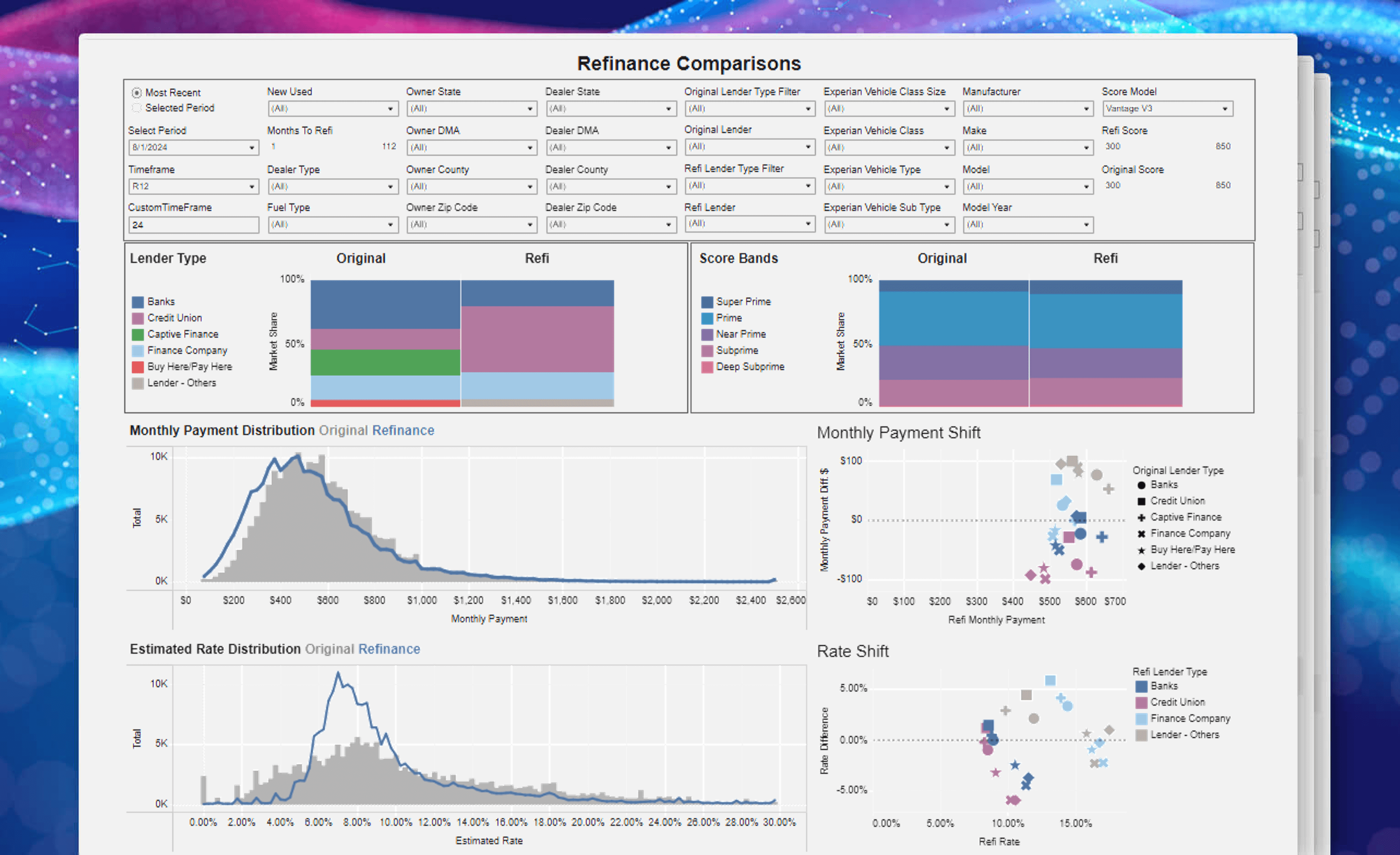

Velocity Refinance enables you to track auto refinance trends in your market. Uncover the customer signals driving demand for you and your competitors.

Comprehensive monthly registrations, enhanced with additional data sources, show new and used auto sales configurable by dealer, lender, and more.

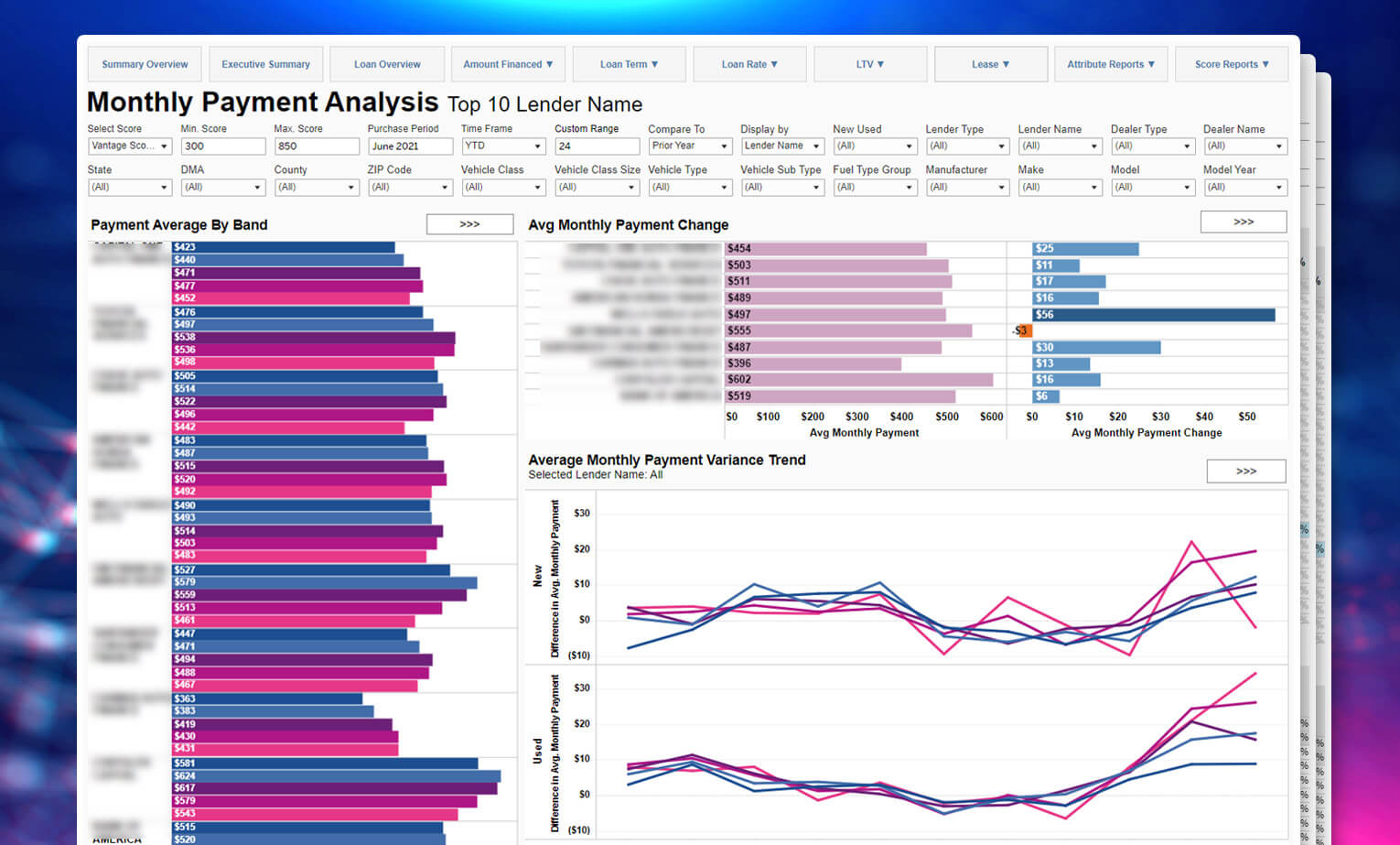

Risk attributes appended to market data offer deeper analysis into loan and lease activity by dealer, peers, and more. Credit tiers, amount financed, monthly payment and rate averages are appended.

J.D. Power new and used vehicle valuation data are integrated to deliver LTV and average values filtered by peer groups, geography and more.