Experian Inclusion and Belonging Resources

Keeping you informed and connected to our I&B events and approach

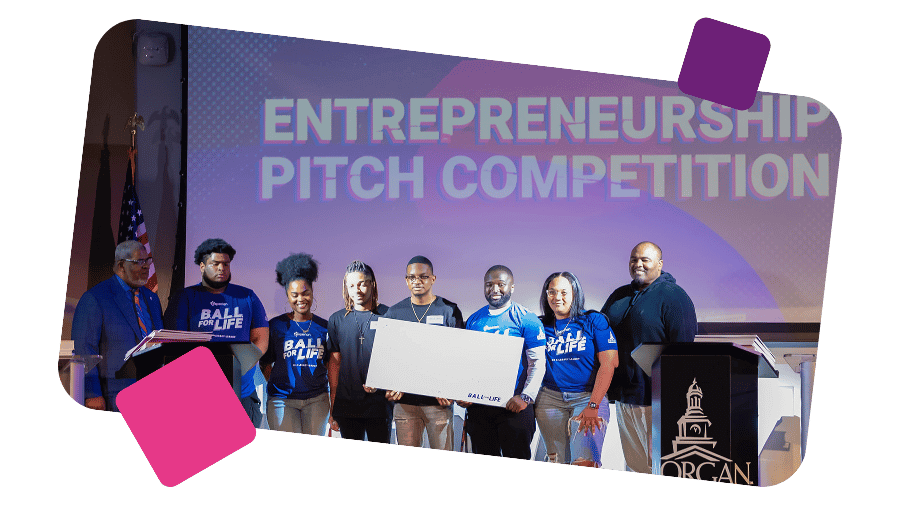

We're proud to work with partners that share our mission: financial inclusion for all.

We collaborate on programs that bring credit and financial education to consumers across our channels and through exciting, interactive live events.

The dream of owning a home or starting a business can seem out of reach for millions in vulnerable populations. Financial inclusion requires us all to find and facilitate solutions. Through Inclusion Forward™, we’re leveraging our data, analytics and technology to help clients expand financial opportunities for their consumers and remove barriers to obtaining credit, thus helping consumers achieve their financial goals

Through our Inclusion Forward™ initiative, we help our clients and communities use powerful tools to remove barriers to credit access and improve financial health. Some of those resources include:

Partnering with Inclusiv to Support CDFIs

We teamed up with Inclusiv Network, one of the leading CDFI associations in the country totaling more than 450 credit union members, to promote financial inclusion to Hispanic/Latino consumers and underserved communities. A key component of this collaboration includes providing resources, including educational webinars and market insights, to help credit unions enhance their outreach to marginalized communities.