White Paper

Published July 1, 2025

Mortgage Advanced Analytics & Modeling Data Sources Marketing

This white paper explores the transformative potential of Home Equity Lines of Credit (HELOCs) in 2025, a year marked by record-high homeowner equity and shifting consumer credit behavior. It offers data-driven insights into how lenders can tap into the $29 trillion in untapped equity by leveraging advanced analytics, behavioral segmentation, and digital innovation to meet evolving borrower needs.

Key Takeaways:

- $29T in Untapped Equity: Millions of homeowners are ideal HELOC candidates but remain underserved.

- Behavior Gap: Many consumers default to credit cards due to misconceptions about HELOCs.

- Smart Targeting: Use data to identify Revolvers and tailor offers that resonate.

- Digital Advantage: Compete with fintechs by streamlining approvals and closings.

Complete the form to access the white paper

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Thank you for your interest

Your free Experian resource is now available. Enjoy!

Tip Sheet

Tip Sheet

2026 Mortgage Lending Guide

Insights from Experian’s 2026 Mortgage Lender Playbook to help lenders drive growth and resilience:

- Expand access to credit using alternative data

- Capture rising home‑equity demand with streamlined solutions

- Improve pricing, risk controls, and performance precision

- Boost ROI with efficient income and employment verification

Webinar

Webinar

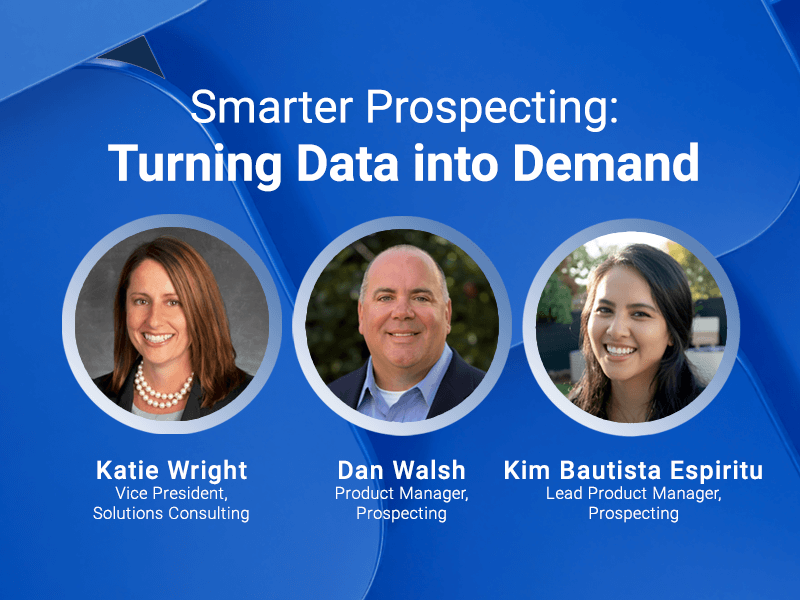

Smarter Prospecting: Turning Data into Demand

The credit marketing landscape is evolving. As competition intensifies and consumer expectations rise, financial institutions that can predict, personalize and perform at scale will define the next generation of success.

In this webinar, our experts explore how financial institutions can use connected intelligence to find, know and grow the right customers, leading to:

- Smarter acquisition

- Stronger customer retention

- More proactive growth

Report

Report

2026 State of the U.S. Housing Market Report: Navigating Uncertainty, Unlocking Opportunity

Gain actionable insights from Experian’s 2026 State of the U.S. Housing Market Report:

- Mortgage market shifts and evolving borrower behaviors

- Affordability pressures and what they mean for homeowners

- Home equity as a key growth lever for lenders

- Macroeconomic trends impacting housing demand and credit

Webinar

Webinar

Unlocking alternative data for smarter fintech decisions

Join Ashley Knight, Experian’s SVP of Product Management, and Haiyan Huang, Prosper’s Chief Credit Officer, to discover how:

- Alternative finance data is redefining how to verify and connect identities.

- Email and phone intelligence is unlocking new levels of precision in credit marketing.

- Open banking insights are becoming increasingly critical for financial inclusion and mitigating risk.