Infographic

Published April 1, 2025

Banks Credit Unions

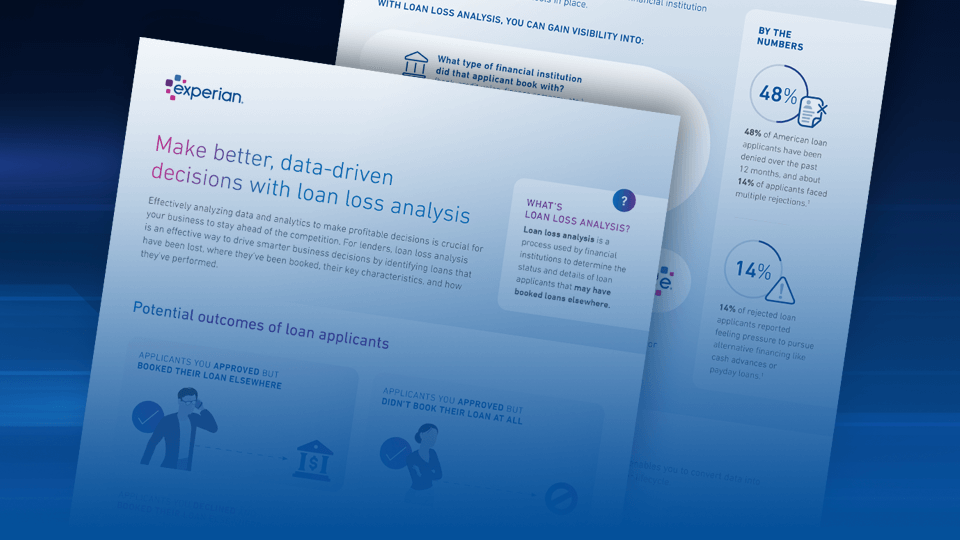

Loan loss analysis is an effective way for lending institutions to drive smarter business decisions by identifying loans that have been lost, where they’ve been booked, their key characteristics, and how they’ve performed.

With loan loss analysis, you can gain visibility into:

- What type of financial institution did that applicant book with (bank, credit union, finance company, etc.)?

- What was the average loan amount, and were others offering more or less?

- What was the estimated interest rate, and how did it compare to yours?

- What was the loan term length?

- What was the average risk score?

Accessing this information can help your organization validate your lending policies or find out where you can make adjustments to remain competitive in the market and win more business.

Click the button below to access the infographic

View now Tip Sheet

Tip Sheet

A companion piece to Bridging the credit divide: income, risk and inclusion in consumer finance

This summary outlines important research findings that help lenders drive a more inclusive environment for customers, while mitigating risk.

A few takeaways:

- Understanding the profiles of who’s more prone to exclusion informs risk management.

- Machine learning techniques can also be deployed to help detect economic interaction effects or shifts.

- Attributes like education level, occupation or rent/utilities payment history have predictive power in credit outcomes.

White Paper

White Paper

Closing the credit gap

Read the latest findings about "Closing the credit gap" white paper, and what they mean for financial inclusion and risk management.

Key insights:

- Income and credit trends reveal significant disparities that impact access to financial products.

- Demographic shifts across gender, household structures, ethnicities, and generations are reshaping borrower profiles.

- Lenders who adapt their strategies and product offerings can expand their customer base, reduce default rates, and lead in inclusive finance.

Case Study

Case Study

Unlocking member insights with alternative data

Every lending decision you make relies on data, but what if that data only tells part of the story? Download our use case to meet two borrowers, Claudia and John, and discover how alternative data can help you:

- Reveal hidden financial stability in members.

- Identify early warning signs of risk.

- Enable more accurate and inclusive lending decisions.

- Drive stronger member relationships.

Tip Sheet

Tip Sheet

Understanding Every Member with Alternative Data

Credit unions exist to serve all members of their communities. Yet millions of financially responsible individuals remain invisible to conventional scoring. Download our alternative data guide to discover:

- The strategic advantages of alternative credit data

- The future of inclusive lending

- Why you should partner with us