Case Study

Published February 4, 2025

Credit Unions Fraud Management Identity

Overwhelmed by evolving fraud attacks and a heavy reliance on manual reviews, a leading credit union turned to NeuroID’s behavioral analytics to spot advanced fraudsters and stop attacks in real time.

Key Results:

- Improved top-of-funnel fraud detection, reducing fraud losses, false positives, and unnecessary step-ups

- Decreased manual review workload, freeing up over 40 hours a month for customer service and growth initiatives

- Real-time detection of attacks, providing improved protection and confidence in fraud mitigation capabilities

Click the button below to access the case study

View now Webinar

Webinar

Protecting Employees’ Identities and Financial Wellbeing

Experian experts discuss how companies are integrating credit education, identity protection, and financial wellness into their employee benefits offerings.

Watch our on-demand webinar to discover:

- Why traditional benefits are no longer enough.

- How to deliver all-in-one financial protection.

- Real-world results from Experian-powered solutions.

- What your employees really want from their benefits.

Report

Report

Protecting Paychecks and Identities

Learn how you can move beyond single-point employee benefit solutions and embrace a more holistic approach that combines:

- Credit education to help employees understand and take control of their credit health

- Financial wellness tools to support budgeting and day-to-day financial confidence

- Identity protection to safeguard what employees have worked hard to build

Infographic

Infographic

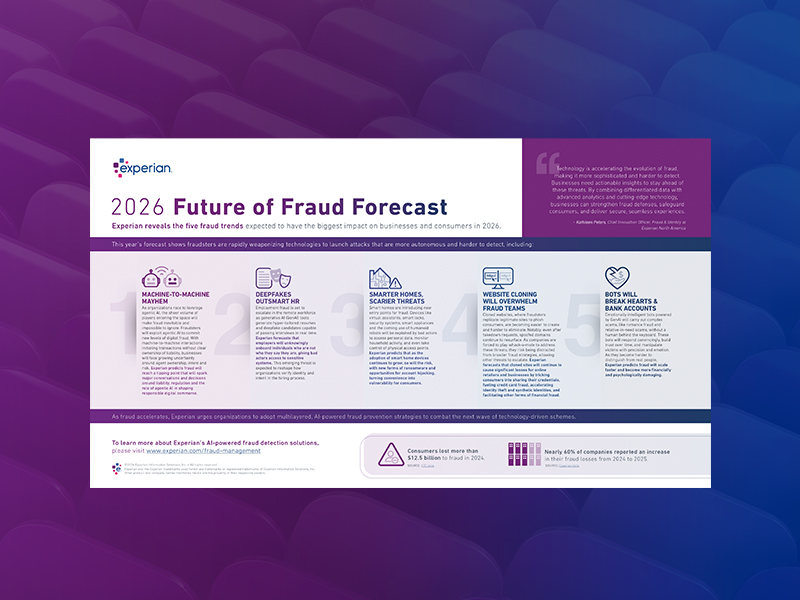

2026 Future of Fraud Forecast

Download Experian’s 2026 Future of Fraud Forecast to explore five fraud trends expected to have the biggest impact on businesses and consumers in the coming year, including:

- Agentic AI and machine-to-machine fraud

- Deepfake-driven employment fraud

- Smart home device exploitation

- Website cloning and emotionally intelligent fraud bots

Tip Sheet

Tip Sheet

A companion piece to Bridging the credit divide: income, risk and inclusion in consumer finance

This summary outlines important research findings that help lenders drive a more inclusive environment for customers, while mitigating risk.

A few takeaways:

- Understanding the profiles of who’s more prone to exclusion informs risk management.

- Machine learning techniques can also be deployed to help detect economic interaction effects or shifts.

- Attributes like education level, occupation or rent/utilities payment history have predictive power in credit outcomes.